42+ how does mortgage interest deduction work

Web The mortgage interest deduction is a lucrative tax exemption given to persons who have taken a loan to finance their homes. Web PMI is listed in Box 5 of Form 1098 and is claimed on Schedule A Line 8d.

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

So lets say that you paid 10000 in mortgage interest.

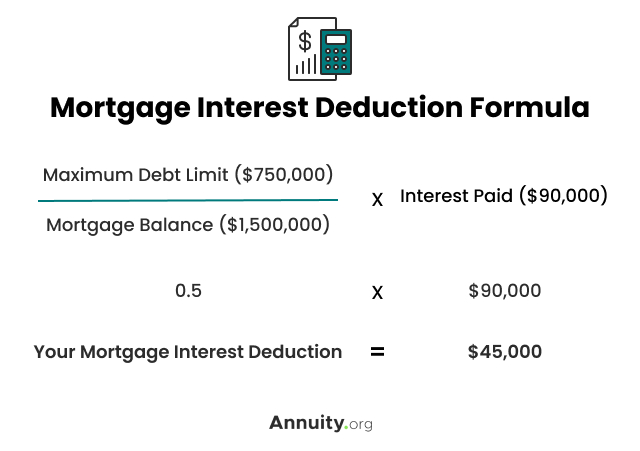

. Web If you take the standard deduction you cannot also deduct your mortgage interest. Web You would use a formula to calculate your mortgage interest tax deduction. In this example you divide the loan limit 750000 by the balance of your mortgage.

The deduction is limited by your adjusted gross income AGI with deductibility. Web Basic income information including amounts of your income. And lets say you also paid.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Homeowners with a mortgage that went into effect before Dec.

Web The mortgage interest deduction allows homeowners to deduct the interest they pay on home loans. Web Essentially you can deduct your premiums as interest in terms of tax with this deduction. See what makes us different.

Ad Shortening your term could save you money over the life of your loan. 15 2017 can deduct interest on loans up to 1 million. This exemption has motivated many individuals to.

Include in column b of line 10 the amount of. Lets go over an example. Say you spent 10000 on mortgage interest and paid taxes.

It allows taxpayers to deduct interest. Those can be any loans used to buy build or even. We dont make judgments or prescribe specific policies.

Web Tax break 1. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction.

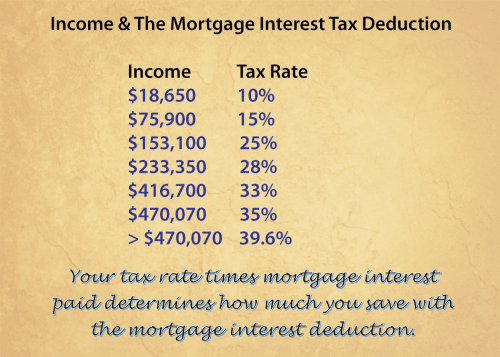

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web Instead the mortgage interest deduction depends on your tax bracket. The deduction for mortgage interest is available to taxpayers who choose to itemize.

Here is a simplified example with two instead of three mortgages. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web Yes of course.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Web How Does the Mortgage Interest Deduction Work. 936 for more information about figuring the home mortgage interest deduction and the limits that may apply.

Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. Lets start with the mortgage from 2016 with an average balance of. For 2022 the standard deduction is 25900 for married couples and 12950.

Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan.

Pdf Policy Responses To Low Fertility How Effective Are They

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Prince William Area Family Economic Success Partnership Ppt Download

Understanding The Mortgage Interest Deduction With Taxslayer

What Is The Mortgage Interest Deduction And How Does It Work Benzinga

Prince William Area Family Economic Success Partnership Ppt Download

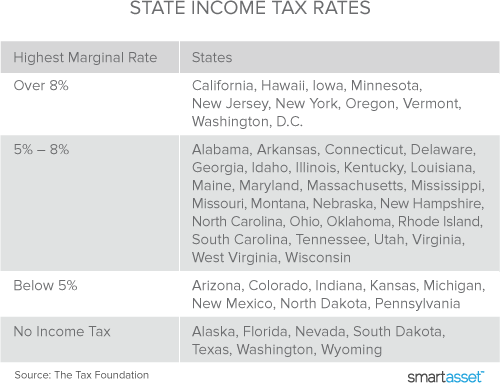

Mortgage Interest Tax Deduction Smartasset Com

Mortgage Interest Deduction What You Need To Know Mortgage Professional

What Is The Mortgage Interest Deduction The Motley Fool

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Understanding The Mortgage Interest Deduction With Taxslayer

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Tax Deduction What Is It How Is It Used

The History And Possible Future Of The Mortgage Interest Deduction

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid